Money Laundering Definition Crime

The concept of money laundering is essential to be understood for those working in the financial sector. It is a course of by which soiled cash is transformed into clean money. The sources of the cash in actual are prison and the money is invested in a method that makes it appear to be clean money and conceal the id of the criminal a part of the money earned.

Whereas executing the financial transactions and establishing relationship with the brand new customers or sustaining present customers the duty of adopting enough measures lie on every one who is part of the organization. The identification of such element to start with is straightforward to take care of as a substitute realizing and encountering such conditions later on within the transaction stage. The central financial institution in any country provides full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present enough safety to the banks to deter such conditions.

Money Laundering Proceeds of Crime and the Financing of Terrorism. It is frequently a component of other much more serious crimes such as drug trafficking robbery or extortion.

Anti Money Laundering Overview Process And History

Drug dealers and purveyors of counterfeit goods and currencies will create money-laundering schemes to hide the source of their earnings.

Money laundering definition crime. Money laundering is the processing of criminal proceeds to disguise their illegal origin. Money laundering refers to a financial transaction scheme that aims to conceal the identity source and destination of illicitly-obtained money. Money laundering is concealing or disguising the identity of illegally obtained proceeds so that they appear to have originated from legitimate sources.

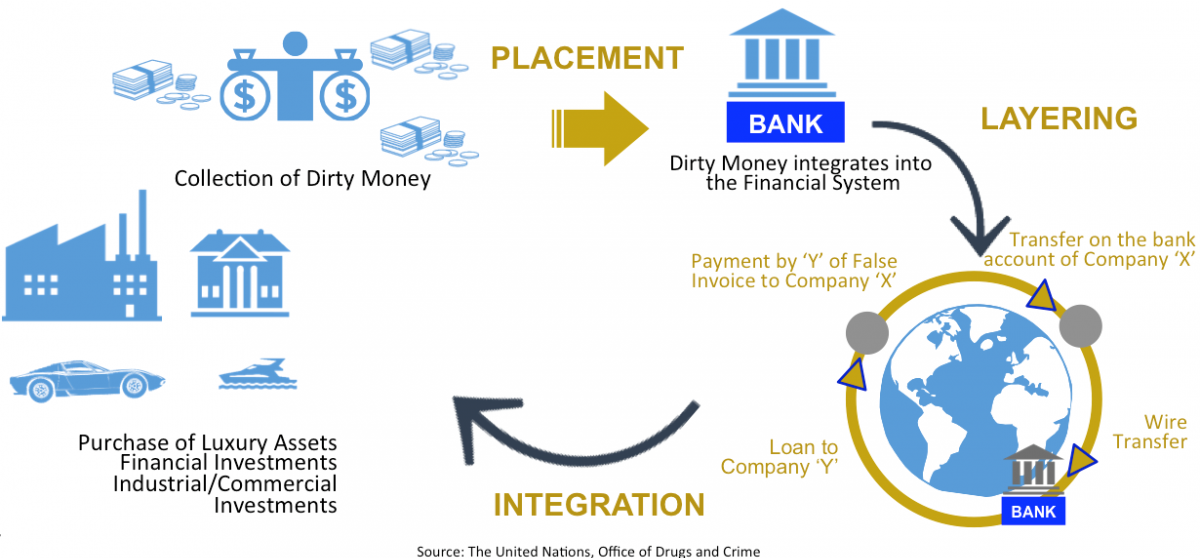

Money laundering is a process which typically follows three stages to finally release laundered funds into the legal financial system. Money is obtained from criminal activity and carefully channelled into legitimate organisations and businesses in order to disguise its. Disguising the trail to foil pursuit.

The placement of the proceeds of crime can be done in a number of ways. First the illegal activity that garners the money places it in the launderers hands. Money laundering in the modern-day tends to be linked with other offences such as cybercrime and online scams the receiving of stolen goods and drugs crime.

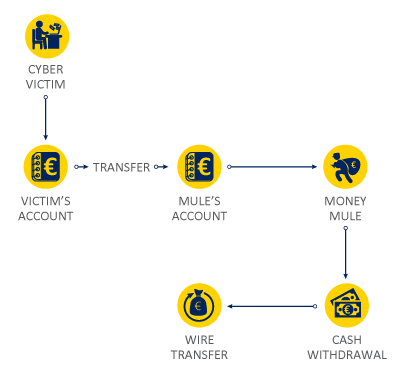

A money mule also known as a smurfer is an individual that is recruited knowingly or unknowingly to act on the behalf of criminals as part of a money laundering scheme. According to this definition money laundering is the process whereby proceeds reasonably believed to have been derived from criminal activity are transported transferred transformed converted or intermingled with legitimate funds for the purpose of concealing or disguising the true nature source disposition movement or ownership of those proceeds. While money mules may historically have been used to transfer physical amounts of cash between locations in a modern financial context they are generally used to.

This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials. Anti-money laundering measures set Money laundering is a transactional crime and is the root cause of many systemic economic social and political problems of Pakistan he concluded. By its very nature money laundering is an illegal activity carried out by criminals which occurs outside of the normal range of economic and financial statistics.

Money laundering is a term used for the unlawful process through which illegitimate assets are converted into superficially legitimate assets. Money laundering is a relatively new type of white-collar crime that is utilized by criminals wishing to conceal profits gained through illegal activities. It is during the placement stage that money launderers are the most vulnerable to being caught.

In the simplest terms money laundering involves the transfer of illegally obtained money into a legal institution ie. Moving the funds from direct association with the crime Layering ie. Money laundering is a threat to the United States tax system in that taxable illegal source proceeds go undetected along with some taxable legal source proceeds from tax evasion schemes.

The money laundering process can be broken down into three stages. Money laundering is the process of disguising criminal proceeds and may include the movement of clean money through the United States with the intent to commit a crime in the future. Money laundering is an offence in its own right but it is also closely related to other forms of serious and organised crime as well as the financing of terrorism.

1956 a 1 a defendant must conduct or attempt to conduct a financial transaction knowing that the property involved in the financial transaction represents the proceeds of some unlawful activity with one of the four specific intents discussed below and the property must in fact be derived from a specified unlawful activity. 3 Stages of Money Laundering. To be criminally culpable under 18 USC.

Money laundering is a necessary consequence of almost all profit generating crimes and can occur almost anywhere in the world. This process is of critical importance as it enables the criminal to enjoy these profits without jeopardising their sourceThrough the Global Programme UNODC encourages States to develop. In addition to organised criminal groups professional money launderers perform money laundering services on.

Along with some other aspects of underground economic activity rough estimates have been. Illegitimate assets include the money or assets acquired through illegal activities such as embezzlement corruption or drug trade.

Environmental Crimes Money Laundering

Understanding Money Laundering European Institute Of Management And Finance

Tanzania Financial Intelligence Unit Money Laundering Definition Kitengo Cha Kudhibiti Fedha Haramu Maana Ya Biashara Ya Fedha Haramu

Money Laundering Meaning And Definition Tookitaki Tookitaki

What Is Money Laundering And How Is It Done

Money Laundering Define Motive Methods Danger Magnitude Control

Money Laundering Terrorist Financing Are You Aware Anti Money Laundering Compliance Unit

6amld 22 Predicate Offenses For Money Laundering Complyadvantage

Money Laundering Crime Areas Europol

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Online Presentation

Understanding Money Laundering European Institute Of Management And Finance

The Phases Of Money Laundering Download Scientific Diagram

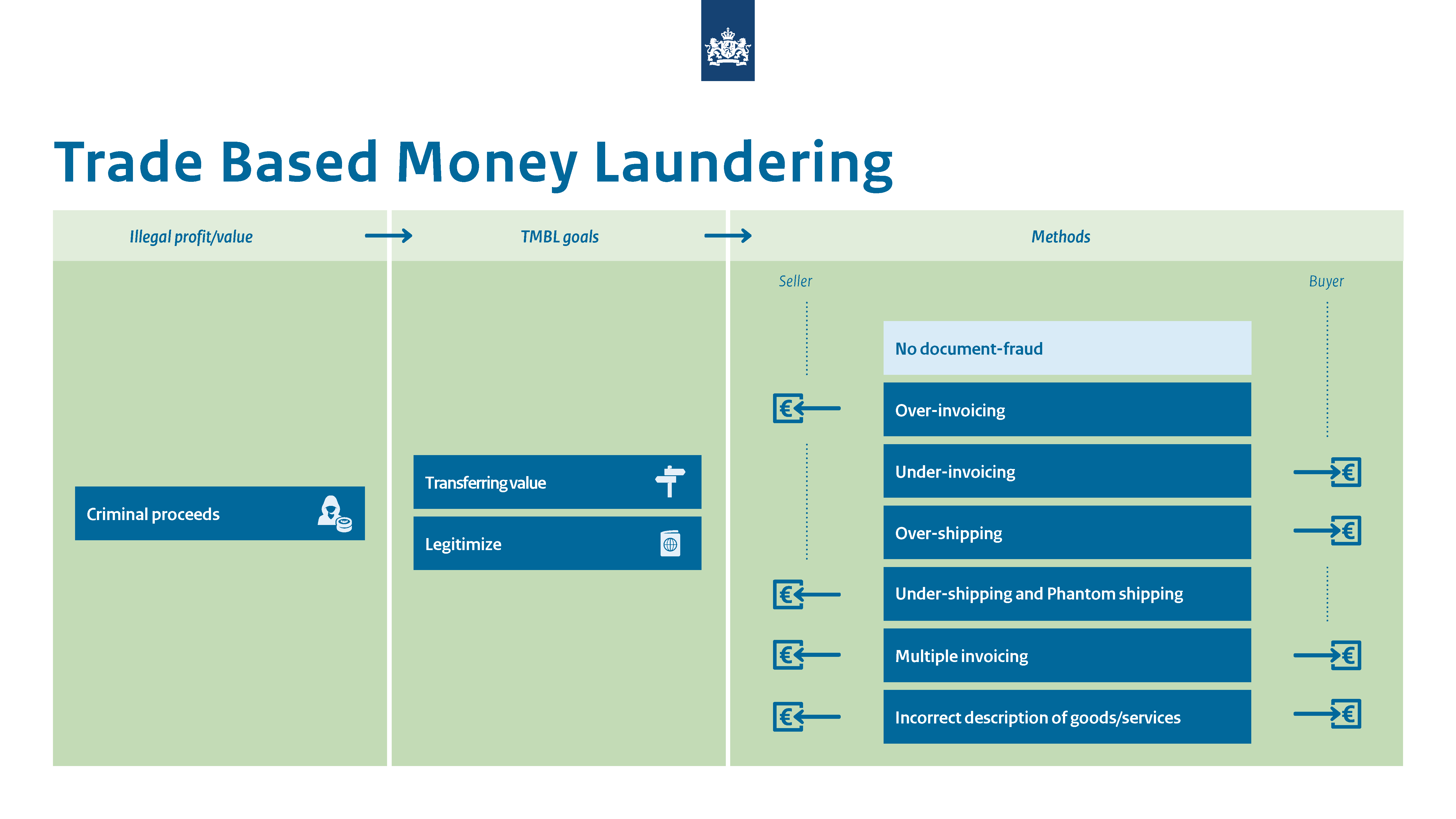

What Is Trade Based Money Laundering Tbml Amlc Eu

The world of regulations can look like a bowl of alphabet soup at times. US money laundering regulations aren't any exception. We have now compiled a listing of the top ten money laundering acronyms and their definitions. TMP Threat is consulting firm centered on defending financial providers by reducing danger, fraud and losses. We now have big financial institution experience in operational and regulatory threat. Now we have a strong background in program management, regulatory and operational risk as well as Lean Six Sigma and Enterprise Process Outsourcing.

Thus money laundering brings many opposed penalties to the group due to the risks it presents. It will increase the chance of main dangers and the chance price of the financial institution and ultimately causes the bank to face losses.

Comments

Post a Comment