Money Laundering Process Examples

The idea of cash laundering is essential to be understood for these working in the monetary sector. It's a course of by which soiled cash is transformed into clean money. The sources of the cash in actual are felony and the money is invested in a method that makes it seem like clean money and hide the id of the legal a part of the money earned.

While executing the financial transactions and establishing relationship with the brand new clients or maintaining present customers the responsibility of adopting sufficient measures lie on each one who is a part of the group. The identification of such element to start with is simple to take care of as a substitute realizing and encountering such conditions in a while in the transaction stage. The central bank in any country provides complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to deter such situations.

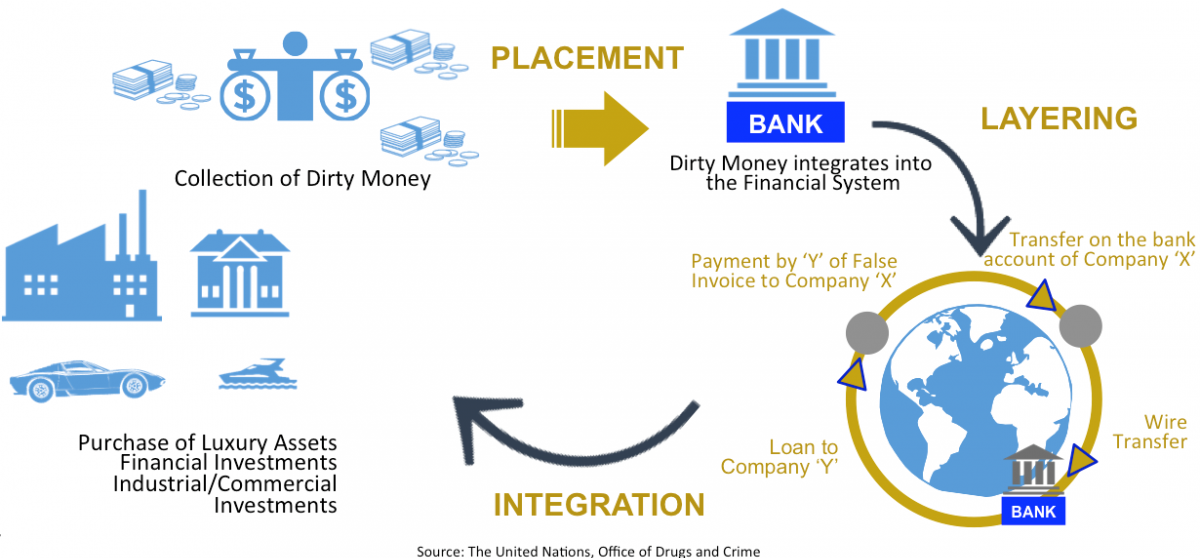

For example the purchases of property artwork jewelry or high-end automobiles are common ways for the launderer to enjoy their illegal profits without necessarily drawing attention to themselves. A Three-Stage Process The money laundering cycle can be broken down into three distinct stages.

What Is Money Laundering And How Is It Done

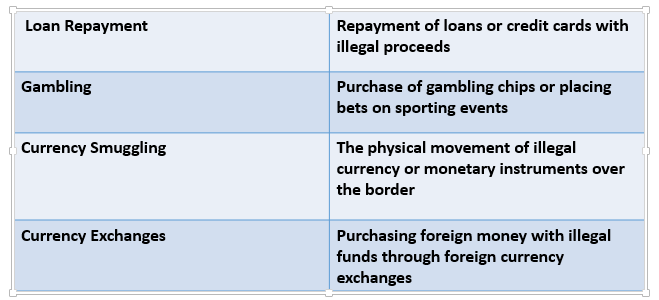

There are several ways the dirty money can be entered into the financial system.

Money laundering process examples. Large-scale money laundering cases often involve global transactions. Money Laundering Example Cases. But plenty get caught.

These are among the most notorious money laundering operations of the past 100 years. How is the Placement Money Laundering Stage Achieved. For example ten smurfs could place 1 million into financial institutions using this technique in less than two weeks.

A process colloquially known as name and shame. Sometimes layering methods will be nested within each other. This stage entails placing laundered proceeds back into the economy to create the perception of legitimacy.

Therefore financial institutions may be. There can be several ways to do money laundering but the most popular is the establishment of the fake companies which is. Most money laundering operations never make national headlines even when theyre detected by the authorities.

Below are some famous examples of money laundering cases. This process is whereby businesses blend illegal funds with legitimate takings. Money will be invested in a business for example which will then open multiple bank accounts or begin investing its funds on the stock exchange.

When money launderers need to clean large sums of money the layering process must become more complex and diverse. Examples of Money Laundering. Paul Manafort and Rick Gates 2006-17.

Money Laundering Example One of the most commonly used and simpler methods of washing money is by funneling it through a restaurant or other business where there are a. Notable Examples of Money Laundering. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities.

Many perpetrators successfully evade accountability. However it is important to remember that money laundering. The six most common examples of crime associated to the placement stage in the laundering money process are.

Securities Brokers Brokers can facilitate the process of money laundering through structuring large deposits of cash in a way that disguises the original source of the funds. Money laundering is not uncommon but some money laundering cases have met the spotlight due to the severity of the act or the amount of money involved in the crime. Blending of Funds The best place to hide cash is with a lot of other cash.

Money laundering is the process of converting dirty money that is money which arises from illegal means such as drug trafficking or prostitution or tax evasion or even from highly placed members in large corporations diverting money to their personal accounts into clean money by using a number of different methods the most common of which is by using banks insurance companies and other financial.

Understanding Money Laundering European Institute Of Management And Finance

What Is Money Laundering And How Is It Done

What Is Money Laundering Three Methods Or Stages In Money Laundering

Money Laundering Stages Methods Study Com

Anti Money Laundering Overview Process And History

Process Of Money Laundering Placement Layering Integration

Money Laundering Examples Chaussureslouboutin Soldes Fr

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft

Aml Introduction Stages Of Money Laundering Learn With Flip Youtube

Cryptocurrency Money Laundering Explained Bitquery

Understanding Money Laundering European Institute Of Management And Finance

What Are The Three Stages Of Money Laundering

The world of laws can appear to be a bowl of alphabet soup at times. US money laundering regulations are no exception. We've got compiled a listing of the highest ten cash laundering acronyms and their definitions. TMP Risk is consulting agency focused on protecting financial companies by reducing danger, fraud and losses. We now have big bank expertise in operational and regulatory risk. Now we have a robust background in program administration, regulatory and operational risk in addition to Lean Six Sigma and Enterprise Process Outsourcing.

Thus cash laundering brings many adverse consequences to the group due to the risks it presents. It increases the chance of main dangers and the opportunity value of the financial institution and finally causes the financial institution to face losses.

Comments

Post a Comment